by Calculated Risk on 10/18/2023 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 6.9 percent from one

week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage

Applications Survey for the week ending October 13, 2023.The Market Composite Index, a measure of mortgage loan application volume, decreased 6.9 percent on

a seasonally adjusted basis from one week earlier. On an unadjusted basis, the Index decreased 7

percent compared with the previous week. The Refinance Index decreased 10 percent from the previous

week and was 12 percent lower than the same week one year ago. The seasonally adjusted Purchase

Index decreased 6 percent from one week earlier. The unadjusted Purchase Index decreased 5 percent

compared with the previous week and was 21 percent lower than the same week one year ago.“Applications decreased to their lowest level since 1995, as the 30-year fixed mortgage rate increased for

the sixth consecutive week to 7.70 percent – the highest level since November 2000,” said Joel Kan,

MBA’s Vice President and Deputy Chief Economist. “Both purchase and refinance applications declined,

driven by larger drops for conventional applications. Purchase applications were 21 percent lower than

the same week last year, as homebuying activity continues to pull back given reduced purchasing power

from higher rates and the ongoing lack of available inventory. The ARM share was 9.3 percent, the

highest share in 11 months, as some borrowers look for alternative ways to lower their monthly payments.

Refinance activity was at its lowest level since early 2023. There is very limited refinance incentive with

mortgage rates at multi-decade highs.”

…

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances

($726,200 or less) increased to 7.70 percent from 7.67 percent, with points decreasing to 0.71 from 0.75

(including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

The first graph shows the MBA mortgage purchase index.

According to the MBA, purchase activity is down 21% year-over-year unadjusted.

Red is a four-week average (blue is weekly). The purchase index is at the lowest level since 1995.

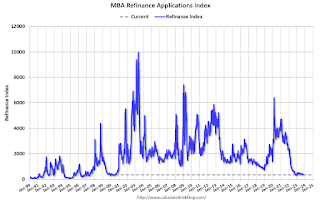

With higher mortgage rates, the refinance index declined sharply in 2022 – and has mostly flat lined at a low level since then.