by Calculated Risk on 10/28/2023 08:11:00 AM

Boo!

The key report this week is the October employment report on Friday.

Other key indicators include the Case-Shiller house prices for August, October ISM manufacturing and services indexes, and October vehicle sales.

The FOMC meets this week and no change to policy is expected.

—– Monday, October 30th —–

10:30 AM: Dallas Fed Survey of Manufacturing Activity for October. This is the last regional Fed survey for October.

—– Tuesday, October 31st —–

9:00 AM ET: S&P/Case-Shiller House Price Index for August. The consensus is for the Composite 20 index to be up 0.1% year-over-year.

This graph shows the year-over-year change in the nominal seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the most recent report (the Composite 20 was started in January 2000).

9:00 AM: FHFA House Price Index for August. This was originally a GSE only repeat sales, however there is also an expanded index.

9:45 AM: Chicago Purchasing Managers Index for October. The consensus is for a reading of 44.8, up from 44.1 in September.

10:00 AM: The Q3 Housing Vacancies and Homeownership report from the Census Bureau.

—– Wednesday, November 1st —–

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for October. This report is for private payrolls only (no government). The consensus is for 135,000 jobs added, up from 89,000 in September.

This graph shows job openings (black line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings increased in August to 9.61 million from 8.92 million in July.

The number of job openings (black) were down 6% year-over-year. Quits were down 14% year-over-year.

10:00 AM: ISM Manufacturing Index for October. The consensus is for 49.0, unchanged from 49.0.

10:00 AM: Construction Spending for September. The consensus is for 0.4% increase in spending.

2:00 PM: FOMC Meeting Announcement. No change to FOMC policy is expected at this meeting.

2:30 PM: Fed Chair Jerome Powell holds a press briefing following the FOMC announcement.

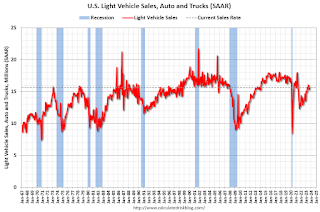

The consensus is for sales of 15.1 million SAAR, down from 15.7 million SAAR in September (Seasonally Adjusted Annual Rate).

This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the current sales rate.

—– Thursday, November 2nd —–

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 214 thousand initial claims, up from 210 thousand last week.

—– Friday, November 3rd —–

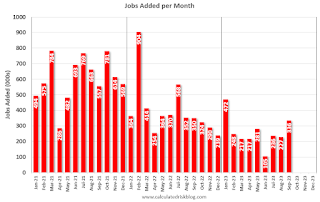

8:30 AM: Employment Report for September. The consensus is for 168,000 jobs added, and for the unemployment rate to be unchanged at 3.8%.

8:30 AM: Employment Report for September. The consensus is for 168,000 jobs added, and for the unemployment rate to be unchanged at 3.8%.

There were 336,000 jobs added in August, and the unemployment rate was at 3.8%.

This graph shows the jobs added per month since January 2021.

10:00 AM: the ISM Services Index for October. The consensus is for a decrease to 53.0 from 53.6.