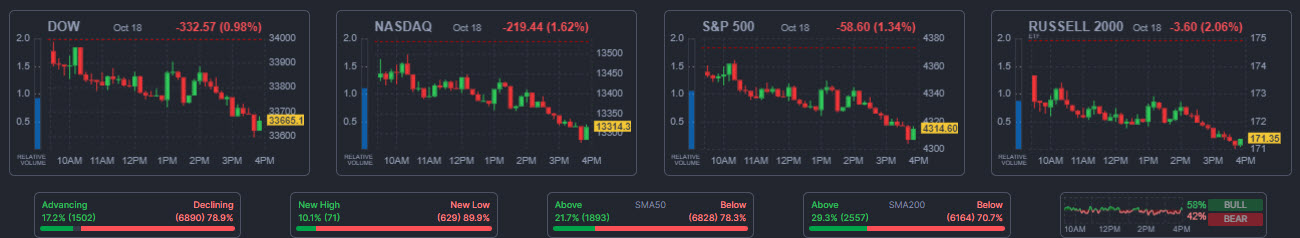

Global stock markets experienced a decline due to increased volatility resulting from escalating tensions in the Middle East, compounded by Fed Powell’s statement which added to the atmosphere of risk aversion. Longer dated yields have climbed again while the short end sustains some of its bid as curve steepening trades take hold. Powell commented that the economy remains resilient because rates have not been high enough for long enough, suggesting the hawkish stance will be maintained. In China, efforts to inject additional cash into the economy might provide support, especially as the country’s stocks had erased all gains from their significant reopening rally late last year. China’s economy has faced challenges this year, including decreased demand and a downturn in the property market.

- USDIndex reverted on EU open from 106.25 to below 106. The VIX extended above 20 breaking 4-month highs.

- Further argument for the doves at the ECB & BOE: GfK consumer confidence & retail sales declined in the UK. The weaker than expected number adds to signs that the economy is cooling, which is adding to arguments against another rate hike from the BOE even as inflation remains high. In Germany, the producer prices declined and prices for consumer goods dropped for a second month. The latter likely reflects waning demand, which is putting pressure on prices.

- Gold and Oil prices continued to climb amid concerns about a potential ground invasion of Gaza by Israel, which could trigger a broader conflict in the Middle East. Gold breached 1984, turning the attention to April’s highs. USOIL extended to $89.20.

- BTCUSD is set to see its biggest weekly gain since June. Currently at 29200.

Interesting Mover: US500 (-3.50%) in a sell off for a 4th day in a row, with immediate support levels at 4265, 4230 and 4200.

Interesting Mover: US500 (-3.50%) in a sell off for a 4th day in a row, with immediate support levels at 4265, 4230 and 4200.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Source Link