- The Euro maintains the bullish bias vs. the US Dollar.

- European markets trade mostly on the defensive on Monday.

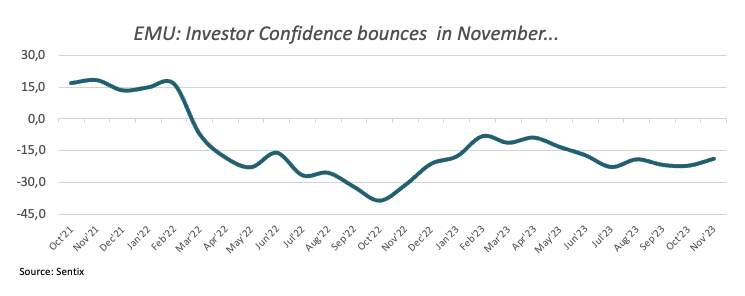

- EMU Sentix Index rebounds in November.

The Euro (EUR) preserves its positively robust sentiment at the beginning of the week vs. the US Dollar (USD), lifting EUR/USD to the 1.0760 zone, or multi-week tops.

Conversely, the Greenback encounters extra downward pressure and compels the USD Index (DXY) to break below the 105.00 support amidst a broadly based improvement in the risk-linked galaxy. The persistent weakening of the Greenback comes in contrast to a mild rebound in US yields across diverse maturities.

In the context of monetary policy, a growing consensus has formed amongst market participants that the Federal Reserve (Fed) will probably maintain its present monetary conditions unchanged for the interim, as the potential for a rate amendment in December seems to have lost some impetus particularly in the aftermath of the latest FOMC meeting and Friday’s publication of weaker-than-anticipated Nonfarm Payrolls for the month of October.

The European Central Bank (ECB) is likely to follow suit, as investors now favour a protracted hiatus of its tightening campaign, most likely until the latter half of the subsequent year.

From the speculators’ view, net longs in EUR rose to five-week highs in the week to October 31 according to the CFTC Positioning Report. During that period, the pair traded within a range bound theme ahead of the ECB event and amidst speculation of a potential rate hike by the Fed by year-end.

On the euro data docket, Germany’s final Services PMI came in at 48.2, and 47.8 when it came to the broader euro area. In addition, Investor Confidence tracked by the Sentix index improved to -18.6 for the euro bloc in November.

In the US, FOMC Governor Lisa Cook (permanent voter, centrist), is due to speak later in the session.

Daily digest market movers: Euro extends the positive performance on USD-selling

- The EUR looks to consolidate the breakout of 1.0700 vs. the USD.

- US and German yields regain some composure on Monday.

- Markets now see the Fed refraining from hiking rates in December.

- The ECB could extend its pause until H2 2024.

- The crisis in the Middle East threatens to extend to other regions.

- BoJ Kazuo Ueda favoured the continuation of large-scale bond purchases.

Technical Analysis: Euro faces the next up-barrier at 1.0800

EUR/USD accelerates its recent gains and flirts with the 1.0750 region on Monday.

The weekly peak of 1.0767 (September 12) comes before the important 200-day SMA at 1.0805 for EUR/USD, while another weekly high of 1.0945 (August 30) occurs before the psychological barrier of 1.1000. Beyond this zone, the pair may face resistance at the August top of 1.1064 (August 10), followed by the weekly peak of 1.1149 (July 27) and the 2023 high of 1.1275 (July 18).

Sellers, on the other hand, are likely to face the next contention at the weekly low of 1.0495 (October 13), prior to reaching the 2023 bottom at 1.0448 (October 15), and the round number of 1.0400.

Meanwhile, the pair’s outlook is expected to stay negative as long as it remains below the 200-day SMA.

ECB FAQs

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy for the region.

The ECB primary mandate is to maintain price stability, which means keeping inflation at around 2%. Its primary tool for achieving this is by raising or lowering interest rates. Relatively high interest rates will usually result in a stronger Euro and vice versa.

The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

In extreme situations, the European Central Bank can enact a policy tool called Quantitative Easing. QE is the process by which the ECB prints Euros and uses them to buy assets – usually government or corporate bonds – from banks and other financial institutions. QE usually results in a weaker Euro.

QE is a last resort when simply lowering interest rates is unlikely to achieve the objective of price stability. The ECB used it during the Great Financial Crisis in 2009-11, in 2015 when inflation remained stubbornly low, as well as during the covid pandemic.

Quantitative tightening (QT) is the reverse of QE. It is undertaken after QE when an economic recovery is underway and inflation starts rising. Whilst in QE the European Central Bank (ECB) purchases government and corporate bonds from financial institutions to provide them with liquidity, in QT the ECB stops buying more bonds, and stops reinvesting the principal maturing on the bonds it already holds. It is usually positive (or bullish) for the Euro.