- Expected drop in core PCE inflation could fuel rate cut bets

- But will Fed officials move a step closer to a dovish pivot?

- Dollar starts week on the backfoot ahead of Thursday’s data due 13:30 GMT

US inflation still headed in the right direction

Whilst CPI inflation suffered a setback from the oil price rally earlier in the year, PCE inflation has maintained a downward trajectory, bolstering expectations that the Federal Reserve will begin cutting rates by the middle of 2024. Specifically, the core PCE price index that the Fed attaches the most weight to for its policy decisions has come down markedly in recent months after stalling around 5% at the start of the year.

Core PCE is expected to have eased from 3.7% to 3.5% y/y in October. That’s still one-and-a-half percentage points above the 2% objective but the slowdown in the month-on-month pace during the course of the year suggests the Fed is well on its way to hitting its target. The question is, though, how soon will it get there, and can it achieve this without tightening further?

Don’t fight the Fed?

Markets have already made up their minds about this and think that with the added slowdown in economic growth and the pullback in oil prices policymakers will need to lower the Fed funds rate at some point over the coming months to prevent policy from becoming too restrictive.

This doesn’t seem like an unreasonable assumption to make. The big danger, though, with this thinking isn’t so much the mere speculation about rate cuts, but just how strong investors’ conviction has been, as the latest pricing in Fed fund futures points to at least three 25-bps cuts by the end of 2024.

Consumer spending may finally be coming off the boil

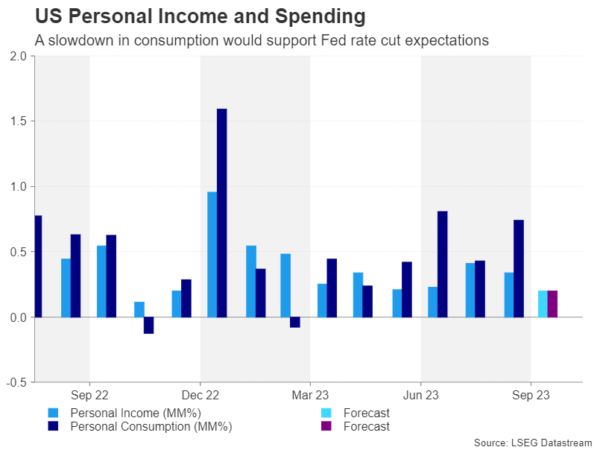

The personal income and spending numbers that will be released alongside the PCE price gauges will likely support the markets’ view. After a bumper few months for the US consumer, personal consumption is expected to have cooled from 0.7% to 0.2% m/m in October, with personal income also projected to have moderated to 0.2% m/m.

Furthermore, the ISM manufacturing PMI that’s due the following day at 15:00 GMT is forecast to remain below the 50.0 level that separates contraction from expansion. The manufacturing PMI has been stuck below 50 since November 2022 and although it likely edged up in November to 47.6, the improvement won’t be enough to ease concerns about stagnating growth.

Aside from the aforementioned reports, investors will also be sifting through the consumer confidence index (Tuesday), the second estimate of Q3 GDP (Wednesday) and the Chicago PMI (Thursday).

Will Powell steer market expectations?

Unless there are some significant positive surprises in the data, investors are not about to alter their predictions for the rate path, keeping the US dollar on the backfoot. However, it is not just economic indicators that traders will have to keep an eye on this week as several Fed officials are scheduled to speak in the coming days, the most important of which will be Chair Powell’s address on Friday (16:00 GMT).

The Fed chief may try to use this opportunity to guide markets in a particular direction before the blackout period begins at the weekend for the December 13-14 meeting.

This would be especially true if investors ratchet up their rate cut bets on the back of softer-than-anticipated data and the Fed then attempts to rein in those expectations. So far, Powell has only been partially successful in doing that, but nevertheless, there is a risk of some dollar volatility if the markets read the latest numbers on the economy one way and the Fed another.

Make or break for euro’s latest rebound

For currencies such as the euro that have reached critical junctures in their recovery against the dollar, the data and the rhetoric coming from the Fed could decide whether their rebound can be stretched any further.

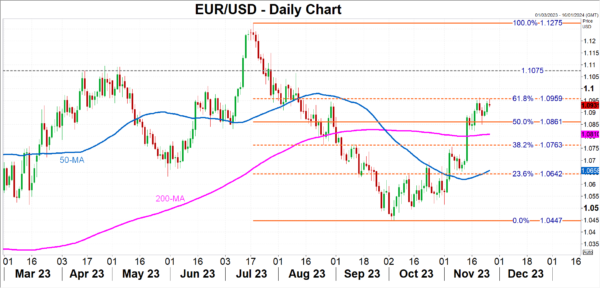

The euro is currently testing the 61.8% Fibonacci retracement of the July-October downleg at $1.0959. A break above this level is possible if the US releases disappoint, setting the stage for a re-challenge of the July peak of $1.1275, although euro/dollar would first have to overcome the $1.1075 hurdle.

But if either the data or hawkish talk from the Fed dampen rate cut expectations, the euro could fall back, seeking support from its 200- and 50-day moving averages at $1.0810 and $1.0658, respectively.