- The pound is trading near a six-month low reached earlier in October.

- UK jobs data indicated a decrease in inflationary pressures.

- The Bank of England (BoE) will likely maintain its current rates next week.

The GBP/USD weekly forecast is bearish as investors have locked their eyes on the Bank of England (BOE), expecting the central bank to wrap up its tightening cycle.

Ups and downs of GBP/USD

The pound ended the week lower due to market apprehension amid the ongoing Middle East war, which boosted the dollar. All eyes are now focusing on the upcoming Bank of England meeting. Currently, the pound is trading near a six-month low of 1.2039, reached earlier in October.

-If you are interested in automated forex trading, check our detailed guide-

Notably, a UK jobs report on Tuesday indicated a decrease in inflationary pressures within the labor market. This data caused the pound to drop, as it reinforced expectations that the BoE would maintain its current interest rates at the upcoming meeting.

Moreover, the British currency was vulnerable to global trends, particularly the dollar’s strength.

Next week’s key events for GBP/USD

Next week, GBP/USD traders will watch monetary policy meetings from the US and the UK. Markets are expecting the Fed to hold rates steady in November. Moreover, they are pricing an 80% chance of the same happening in December.

Meanwhile, several reports this week confirmed the expectation that the Bank of England (BoE) will maintain its current rates during its policy meeting next week. The BoE will likely keep the rates unchanged at 5.25% on November 2, as per the consensus among most economists.

Finally, market participants will focus on US employment data, which might show continued strength in the labor market.

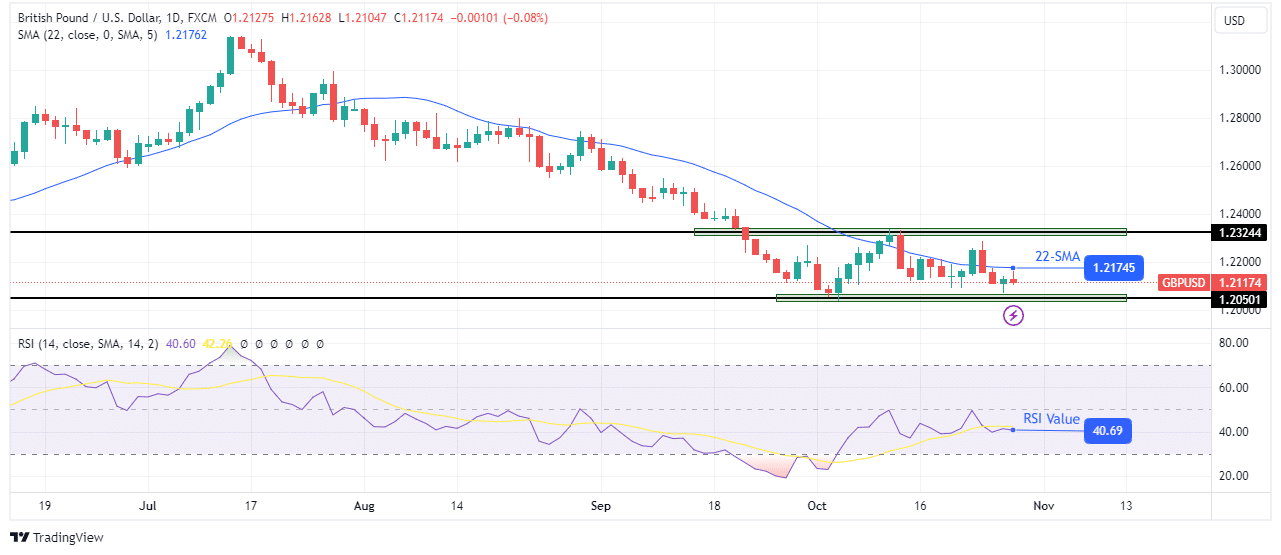

GBP/USD weekly technical forecast: Bears set to retest 1.2050 support.

On the charts, the GBP/USD pair trades between the 1.2050 support and the 1.2324 resistance levels. Although the price is chopping through the 22-SMA, the RSI shows that bears have the upper hand. The RSI trades in bearish territory under 50. Moreover, the previous trend was bearish, with the price respecting the 22-SMA as resistance. It makes it likely the downtrend pauses as bears take a break.

If you are interested in guaranteed stop-loss forex brokers, check our detailed guide-

As such, there is a high chance bears will challenge the 1.2050 support in the coming week. A break below this support would continue the downtrend. However, if the price breaks above the 1.2324 resistance, we could see a bullish trend reversal.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.