- Data since the last ECB meeting continue to point to a wounded Eurozone

- Investors see no more rate hikes and anticipate a series of cuts in 2024

- How will Tuesday’s preliminary PMIs (08:00 GMT) affect those bets and the euro?

Was ECB’s September hike the last one?

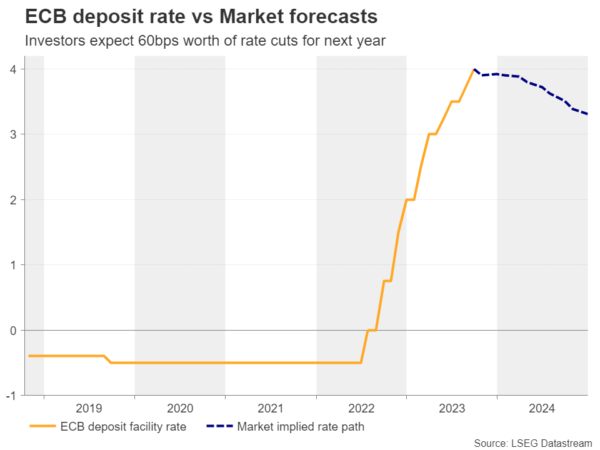

At its September meeting, the European Central Bank (ECB) decided to raise interest rates by another 25bps, lifting the deposit facility rate to a record high of 4%. Nonetheless, with data heading into the meeting pointing to profound cracks in the Euro area economy, officials hinted that this could be the last rate increase in this tightening cycle.

Thus, despite the delivery of a rate hike, the euro tumbled on the hints of that being the last one, and market participants began pricing in a series of rate cuts for 2024. Even after several policymakers, including President Lagarde, pushed against rate cut bets the following days, investors were not convinced.

Data and ECB rhetoric since then suggest so

Since then, economic data has continued to point to an injured economy. Despite the improvement in the September PMIs, all indices remained below the 50 barrier that separates expansion from contraction, with the composite index rising only to 47.1 from 46.7.

Most importantly, the preliminary CPI numbers for last month showed that inflation slowed by more than expected, with the ultra-core rate that excludes energy, food, alcohol tobacco sliding to 4.5% y/y from 5.3%. Even the headline rate dropped to 4.3% y/y from 5.2%, despite the rally in oil prices during the month.

Although all the HICP rates are more than double the ECB’s objective of 2%, recent remarks by policymakers that inflation is on its way back to the target, even without more hikes, allowed market participants to assign a 95% probability for no action at next week’s gathering, with the remaining 5% pointing to one last 25bps increase. Even in December that probability does not rise much. It just goes to 12%, while for next year, investors are anticipating around 60bps worth of rate reductions, even though ECB officials have been arguing that for the inflation objective to be met, rates may need to be held steady.

Source Link

Source Link