- The ECB rate-setting meeting dominates this week’s busy schedule

- Market does not expect a rate change; focus on statement and overall rhetoric

- Decision will be announced on Thursday 12.15 GMT, press conference at 12:45 GMT

ECB travels to Greece for another meeting

The European Central Bank is holding its penultimate meeting for 2023 on Thursday, a week before the Fed gathering. This fact alone increases the pressure on the ECB to avoid shocking the market with its announcements. To be fair, unlike September, this gathering is expected to generate fewer headlines, especially as the market is assigning a 1% probability for a 25bps rate move; a rather odd situation considering the current rate hiking cycle is theoretically still alive.

This market expectation reflects the numerous dovish comments from ECB officials since the September meeting. Even the more hawkish ECB members, for example France’s Villeroy, have been vocal that no extra rate hikes are needed at this stage. This stance could be part of an agreement made at the September gathering between hawks and doves for a final rate hike in exchange for less hawkish rhetoric from the uberhawks.

Market fully prices in a rate cut in mid-July 2024

However, the market is a firm believer that the ECB will not hike again during this current tightening cycle. Similar to the Fed pricing, the next fully priced-in rate move is expected to be a 25bps rate cut at the July 2024 meeting. While this could be confirmed, the geopolitical developments could completely shift the monetary policy outlook. A possible escalation in the Middle East could exponentially increase the risk of another rally in oil and gas prices, like the ones seen in 2022 that caused exceptionally high inflation rates over the past 18 months.

Therefore, at this week’s meeting the ECB is expected to appear slightly less dovish than currently anticipated. It costs little to the President Lagarde et al to keep the door open for a December or even for a first-quarter of 2024 rate move if global supply issues threaten another jump in inflation and/or second-round effects continue to keep inflation at levels not consistent with the targeted price stability.

Alternatively, a discussion for an earlier stop of PEPP reinvestments, from the current end-2024 target, could also do the trick of informing the market that the ECB is in waiting-mode but not ready to signal the end of its tightening bias.

ECB needs time to evaluate the situation

Patience will probably be the key word at the meeting as the ECB wants more time in order to evaluate geopolitical developments and their economic implications, and allow the past rate hikes to feed through the system. President Lagarde has been quite vocal about the strong transmission of monetary policy changes but with the M3 money supply dropping to negative territory, there is increasing risk of a more protracted downturn than currently anticipated by the ECB, further complicating the economic outlook and giving rise to “stagflation” headlines.

In addition, the new ECB staff forecasts will be available in December. There have been a couple of comments from ECB officials stating their confidence that the 2% target will be met by 2025 after the September forecasts had inflation dropping to 2.1% by end-2025.

Moreover, with the final ECB meeting for 2023 scheduled for December 14, two more inflation reports and the preliminary GDP prints for the third quarter of 2023 will be published by then. A plethora of upside surprises at these data releases along with an unwanted and persistent rally in oil and gas prices could tick many boxes for another, possibly final, rate hike by the ECB.

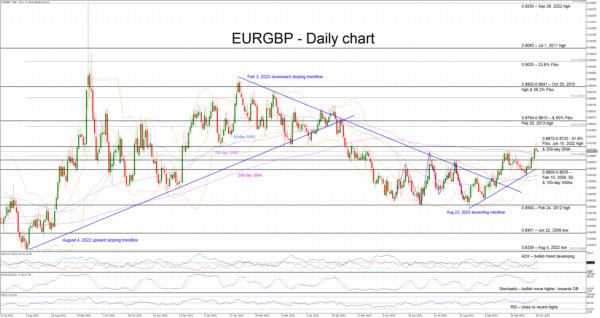

The euro could get a strong boost from a more hawkish ECB

After being on the backfoot for most of 2023, the euro-pound pair has been moving along an ascending trend since the September lows, despite the ECB’s change of stance and weaker economic data releases. With the market expecting a balanced meeting, the recent newfound euro strength could get a real boost from a more hawkish ECB. This outcome could result in a rally towards the 0.8794-0.8815 area, opening the door for 0.9800 level. On the flip side, an eventless meeting could cause a smaller market reaction but potentially offer the excuse to the euro bears to stage a move towards the 0.8600 area.