- The dollar was generally weaker as investors awaited the US nonfarm payrolls report.

- An increase in nonfarm payrolls pointed to a still robust labor market.

- The US unemployment rate rose, indicating some softness in the labor market.

The GBP/USD weekly forecast carries a mild bearish bias, primarily due to the enduring strength of the US labor market, indicating a prolonged hawkish stance by the Fed.

–Are you interested to learn more about forex options trading? Check our detailed guide-

Ups and downs of GBP/USD

The pound had a bullish week as the dollar eased amid a drop in Treasury yields. Moreover, the dollar was generally weaker as investors awaited the US nonfarm payrolls report. The week was filled with key reports from the US, while the UK did not release any major ones.

An increase in nonfarm payrolls, job vacancies, and a lower initial jobless claims figure pointed to a still robust labor market. However, private employment fell, and the US unemployment rate rose, indicating some softness in the labor market. The result was a generally weaker dollar and a stronger pound. Still, the overall picture is of a robust labor market that could prompt one more Fed hike.

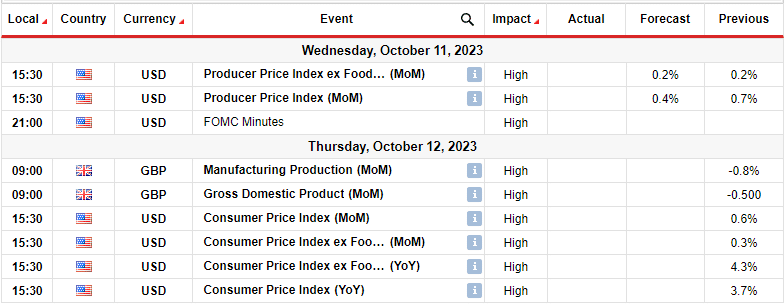

Next week’s key events for GBP/USD

The US will release major reports in the coming week, including producer prices, the FOMC minutes, and the CPI report. On the other hand, the UK will release data on manufacturing production and the gross domestic product.

The producer prices and the CPI reports will show the state of inflation in the US. Therefore, these reports will give investors clues on the Fed’s policy outlook.

UK GDP data will show economic growth in the country amid high interest rates.

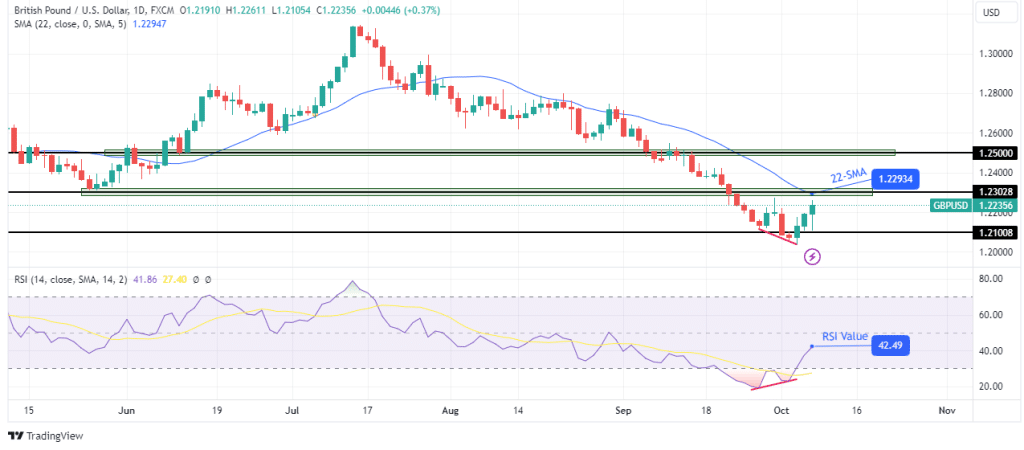

GBP/USD weekly technical forecast: Bears maintain grip

The GBP/USD price has rebounded on the daily chart after bears paused at the 1.2100 support level. However, the rebound has not changed the general direction of the pair. The bearish bias still holds, with the price below the 22-SMA. Moreover, the RSI indicates strong bearish momentum, meaning bears are still stronger.

–Are you interested to learn about forex bonuses? Check our detailed guide-

Notably, the rebound follows a bullish divergence in the RSI. When the bears reached the 1.2100 support level, they made two attempts to break lower. Although the second attempt pushed the price lower, there was weaker momentum, as seen in the RSI. This weakness allowed bulls to take charge. However, the rebound might pause at the 1.2302 resistance level, allowing bears to continue the downtrend.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.