- Gold price closed the week higher as the dollar struggled.

- The US inflation cooled down, putting pressure on the greenback.

- Technical correction may occur in gold amid profit taking.

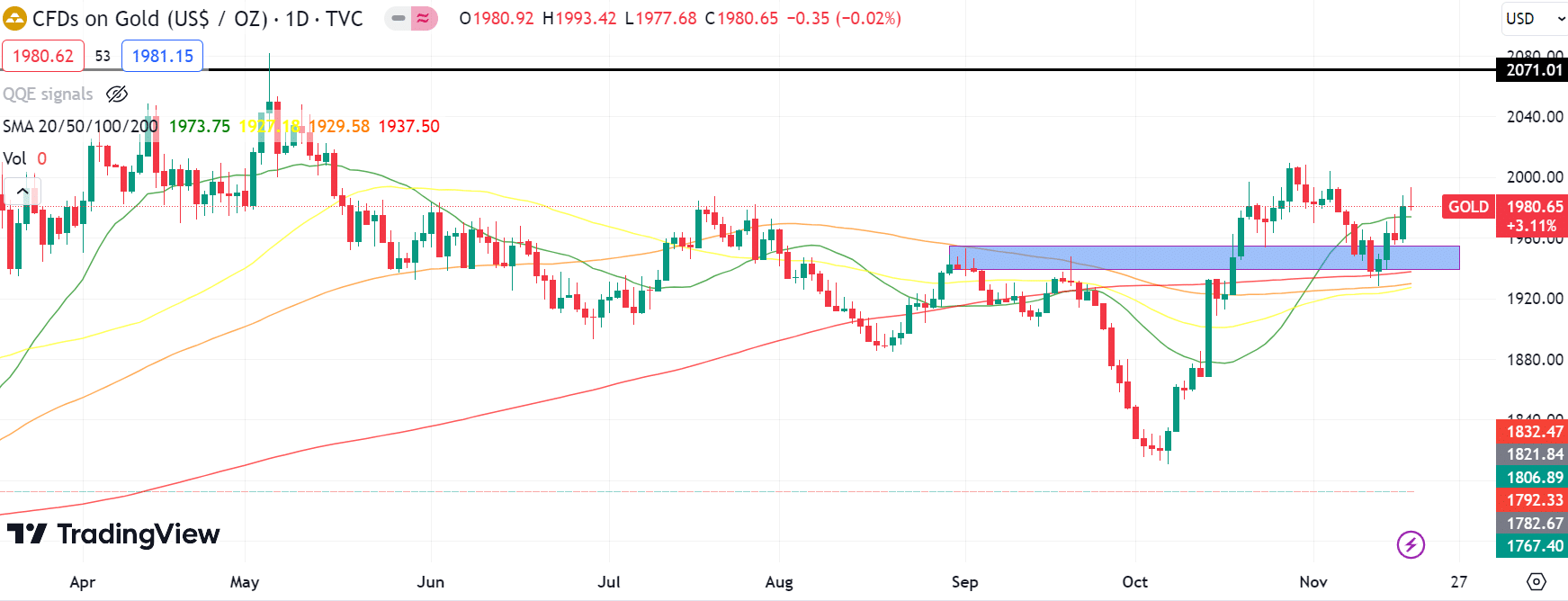

Gold weekly forecast is bullish as the price surged by 2.5% last week. The US Dollar weakened, and US Treasury bond yields declined. The upcoming week lacks significant macroeconomic events, providing an opportunity to focus on the technical analysis of XAU/USD for potential trading opportunities.

–Are you interested to learn more about forex bonuses? Check our detailed guide-

Ups and down last week

Gold underwent a technical upside correction on Monday, driven by the absence of impactful data releases. Tuesday saw Gold gaining momentum, surpassing $1,970. Notably, the US Consumer Price Index (CPI) indicated a monthly decrease in inflation from 0.4% in September to -0.1% in October, settling at 3.2% for the year.

During the same period, the core CPI, excluding volatile energy and food prices, rose by 4%. The USD faced significant selling pressure, dropping by over 3% as the 10-year US Treasury bond yield fell below 4.5%. Consequently, XAU/USD saw an increase of more than 1%.

US Retail Sales for October declined by 0.1%, outperforming the market’s forecast of a 0.3% contraction. However, Thursday’s initial jobless claims rose, impacting the dollar’s performance. Additionally, the Federal Reserve reported a 0.6% decrease in Industrial Production for October. Despite midweek volatility, gold made strides, moving towards $1,980.

Even on the last trading day of the week, with falling UST yields, Gold continued its upward trend, peaking above $1,990, marking its highest point in a while. Positive sentiment was fueled by Federal Reserve Vice Chair Philip Jefferson’s statement that the bank’s balance sheet has no immediate end. Gold demand remained strong, with Indian buyers overlooking local price increases during Diwali festivities and China’s continuous accumulation of gold holdings maintaining high premiums.

Gold’s key events next week

The Federal Reserve will release meeting minutes on Tuesday, but market reactions are expected to be subdued as the focus shifts to a potential Fed policy change in 2015.

Wednesday’s US economic docket includes October Durable Goods Orders and weekly Initial Jobless Claims. The market’s response will likely follow the usual pattern, with worse-than-forecast numbers affecting the dollar negatively and stronger supporting figures.

Thursday marks the closure of US markets for the Thanksgiving Day holiday, followed by a half-day on Friday. Thin trading conditions may limit market response to S&P Global’s preliminary Manufacturing and Services PMI surveys for November.

Given the current market trends, investors should closely monitor technical changes in XAU/USD for potential opportunities.

Gold weekly technical forecast: Buyers awaiting pullback

The gold’s daily chart shows the price slowly climbing to the all-time highs of $2,075. The price maintains a well bid tone above the key SMAs. However, Friday’s close suggests a mild downside correction amid profit-taking.

–Are you interested to learn more about crypto signals? Check our detailed guide-

Hence, the metal may gather to buy traction once it dips to the demand zone. Breaking the zone may attract sellers, changing the outlook to bearish.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.