- The Federal Reserve maintained its current interest rates on Wednesday.

- The US reported weaker-than-expected employment figures.

- Australia’s central bank might increase its key policy rate by 25 basis points on Tuesday.

The AUD/USD weekly forecast radiates optimism as traders eagerly await the RBA’s monetary policy meeting scheduled for Tuesday. A looming rate hike is fueling expectations of an upward trajectory in the currency pair.

Ups and downs of AUD/USD

Aussie ended the week higher amid increased bets of an RBA rate hike next week. Moreover, dollar weakness helped support the Australian dollar. On Wednesday, the Federal Reserve maintained its current interest rates. Furthermore, there is a big chance that US rates have peaked as rising Treasury yields might do the rest of the job for the Fed.

-Are you looking for forex robots? Check our detailed guide-

More dollar weakness came on Friday after the US reported weaker-than-expected employment figures. At the same time, the unemployment rate rose, showing a weakening labor market.

Next week’s key events for AUD/USD

Traders are looking forward to the Reserve Bank of Australia monetary policy meeting on Tuesday. Notably, a Reuters poll found that Australia’s central bank will likely increase its key policy rate by 25 basis points to 4.35% on Tuesday.

Last quarter saw inflation exceeding expectations, which took policymakers by surprise. Consequently, financial markets have adjusted their expectations, factoring in one more rate hike from the Reserve Bank of Australia.

Economists have anticipated a final rate hike this quarter since August. However, the latest Reuters poll marks the first time in several months where there is almost unanimous consensus among participants regarding the rate increase.

AUD/USD weekly technical forecast: Price undergoes significant sentiment shift.

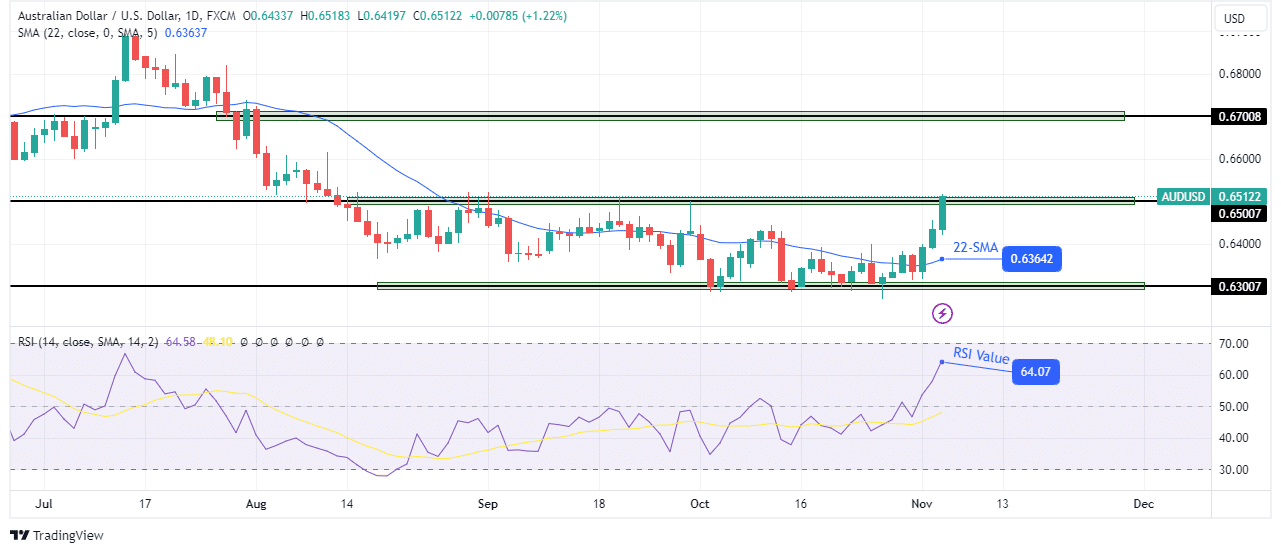

On the daily chart, there has been a significant shift in sentiment for AUD/USD as the price has crossed above the 22-SMA. At the same time, the RSI has crossed above 50, a level that has acted as resistance for some time.

-Are you looking for the best CFD broker? Check our detailed guide-

Notably, the downtrend weakened when the price crossed below the 0.6500 key level. The slope of the downtrend became shallower, and the price stayed close to the 22-SMA. It was a sign that bears had weakened. Finally, the price came to a halt at the 0.6300 support level. It allowed the bulls to take charge by pushing above the SMA.

Currently, the price is climbing and challenging the next resistance level at 0.6500. A break above this level would strengthen the bullish bias.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.