Global markets have been gripped by escalating tensions in the Middle East, with particular focus on the ongoing conflict between Israel and Hamas. Oil prices, which had slightly eased last week, are once again on edge due to concerns that the conflict might disrupt supplies. The Energy Information Administration’s recent data indicated a drop in demand and an unexpected rise in US crude inventories, adding to the market’s cautious atmosphere.

Oil Market Uncertainty:

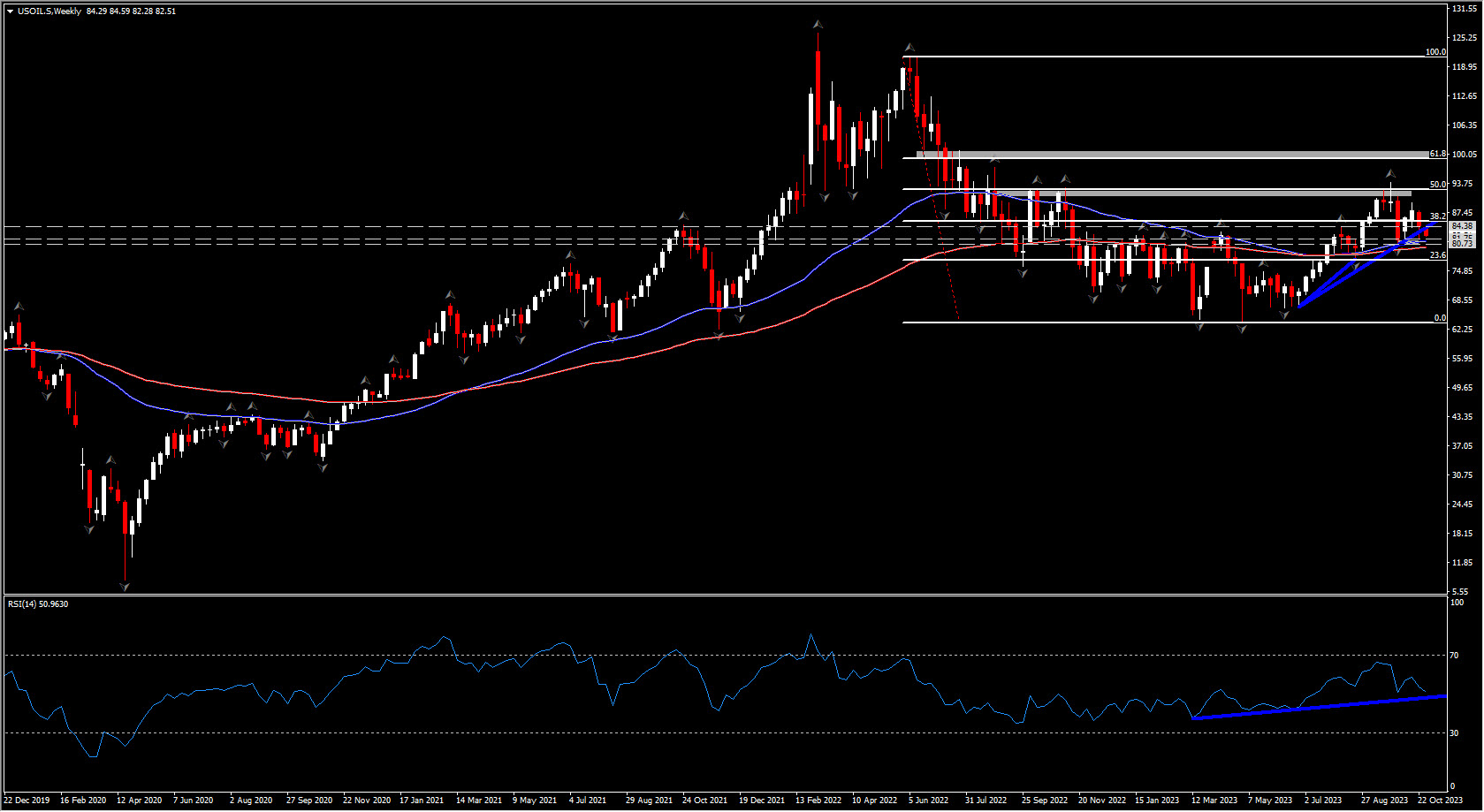

USoil is currently trading at $84.07 per barrel, reflecting a further 1.7% decline. Brent crude stands at $89.05. Despite a relative calm in prices at the beginning of the week, the possibility of an escalation in the Israel-Hamas conflict continues to be a significant worry. The World Bank has warned that under a “large disruption” scenario akin to historical events like the Arab oil boycott of the West in 1973, oil prices could soar to record highs of $150 a barrel. Even a “small disruption” scenario could push prices into the range of $93-102 per barrel.

Precious Metal Rally:

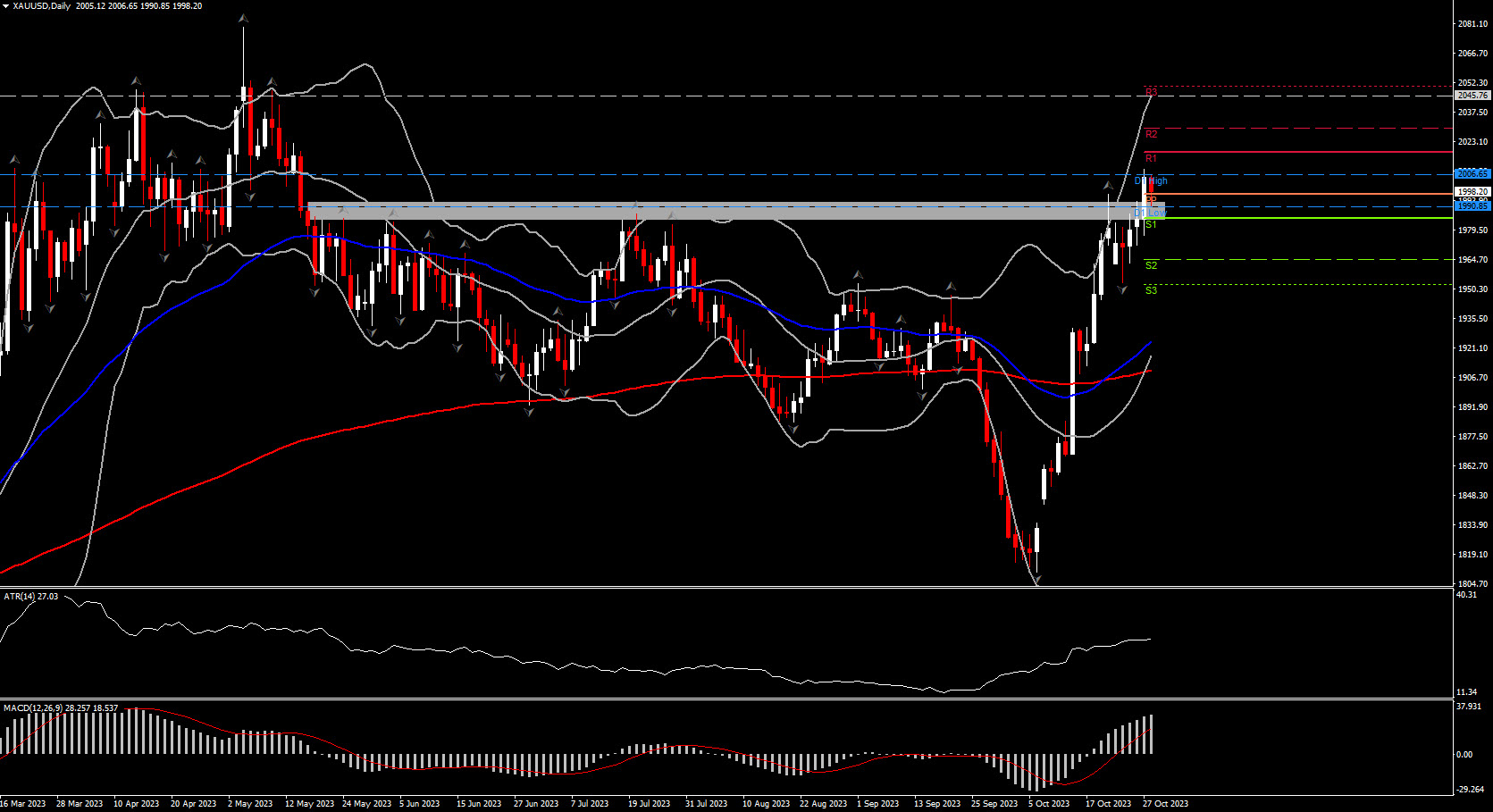

On the precious metals front, gold breached the $2,000 level for the first time since May, maintaining its position at $2,002.29. The metal’s price surge is attributed to increased risk aversion, driven by geopolitical tensions. Safe-haven demand continues to bolster gold prices, with investors closely monitoring developments in the Middle East and awaiting the Federal Reserve’s upcoming announcement, which could further influence market dynamics.

Gas Price Volatility:

In the gas market, prices have experienced fluctuations. While US gas prices fell, European gas prices, especially in the Netherlands and the UK, saw significant hikes due to renewed concerns about supply disruptions from the Middle East. Egypt’s suspension of natural gas imports, combined with Israel’s halting of gas production from its Tamar gas field, has heightened worries about potential supply shortages. Additionally, security concerns regarding Qatari LNG vessels passing through the Strait of Hormuz have added to market jitters.

Amidst these uncertainties, Norway’s state-backed energy company Equinor reported that European gas supplies are in a better position than last winter, despite Russia’s reduced gas supplies. Equinor’s CEO highlighted that the company has overcome challenges related to maintenance, ensuring gas and oil production is back to normal levels.

As global markets navigate these uncertainties, investors remain on high alert, closely monitoring geopolitical developments and their implications on energy supplies and precious metal prices. The situation in the Middle East continues to be a focal point, shaping market sentiments in the days to come.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.