Investors cheered the approval of a trillion-yuan sovereign issue as a harbinger of stimulus, while the Chinese government unveiled new support plans that include issuing additional sovereign debt and lifting the budget deficit ratio to finance fresh measures. Hong Kong reversed a pandemic-increase in stock trade levies and Chief Executive John Lee also announced a plan to halve taxes on home purchases for residents as well as non-residents. That helped to boost property stocks, even as troubled Chinese developer Country Garden Holdings Co. was deemed to be in default on a dollar bond for the first time

- Stock markets got a boost from fresh stimulus measures for China. The Hang Seng has pared some of its early gains, but is still up 1.0%, while the CSI300 has lifted 0.6% and the JPN225 0.7%.

- European stocks: In the red today weighed by a flurry of bank results and a mixed batch of US Big Tech earnings ahead of the ECB decision tomorrow.

- Microsoft, Alphabet, and Visa reported their earnings, which indicated strong performance with revenue and net income growth in their respective quarters.

- Alphabet (-6% in after-hours) sales beat damped by cloud computing miss.

- Microsoft’s (+4% in after-hours) unexpected rebound in Azure cloud growth lifted shares.

- Snap Inc. also reported revenue growth but experienced operating and net losses in the same period.

- Santander net profit rose 20% on record-high interest rates.

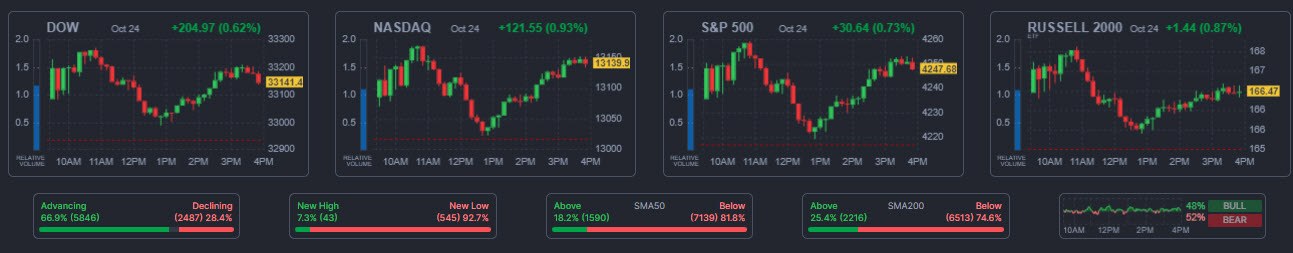

- FED: PMIs kept a Fed rate hike through the January 31 FOMC decision on the table with a 40% probability.

- USDIndex: returned above 106, but held sideways.

- AUD