Asian markets sold off after a weaker close on Wall Street on Friday. Mainland China bourses underperformed as investors remain dissatisfied with official support measures and the lack of further rate cuts. Futures are under pressure across Europe and the US, amid signs that war jitters are easing as investors watch diplomatic efforts to contain the Israel-Hamas conflict. The 10-year Treasury yield has backed up 5.1 bp to 4.97%, the German 10-year rate is up 2.9 bp and the 10-year JGB yield jumped 2.6 bp. Oil and gold declined this morning driven by concerns regarding the sustained period of elevated interest rates and tensions in the Middle East.

- USDIndex turns below 106, EURUSD extends to 1.0593. The VIX climbed to the highest since March and the banking stresses.

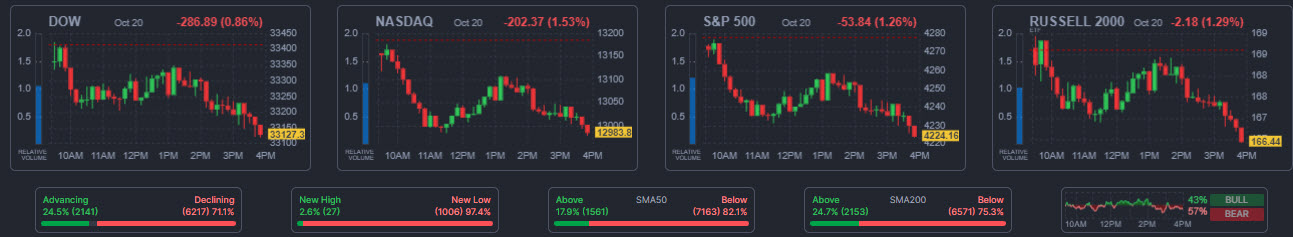

- Stocks: China’s tech gauge drifts to record lows since its inception more than three years ago, worn down by concerns over higher US rates’ impact on global liquidity and a weak export outlook. The US100 plunged -1.53% to 12,983, below 13k for the first time since May. The US30 was off -0.86%. A flight to quality boosted demand for Treasuries, especially after the dovish reading on Chair Powell’s comments.

- Earnings season ramps up this week, with a slew of big tech titans slated to report, i.e. Alphabet, Amazon, Meta and Microsoft.

- USOIL corrected to $86.80 per barrel and Gold recovered to $1981 as risk aversion recedes for now.

- BTCUSD saw its biggest weekly gain since June. Currently at 30540.

Interesting Mover: US500 (-1.53%) to 4236,Source Link