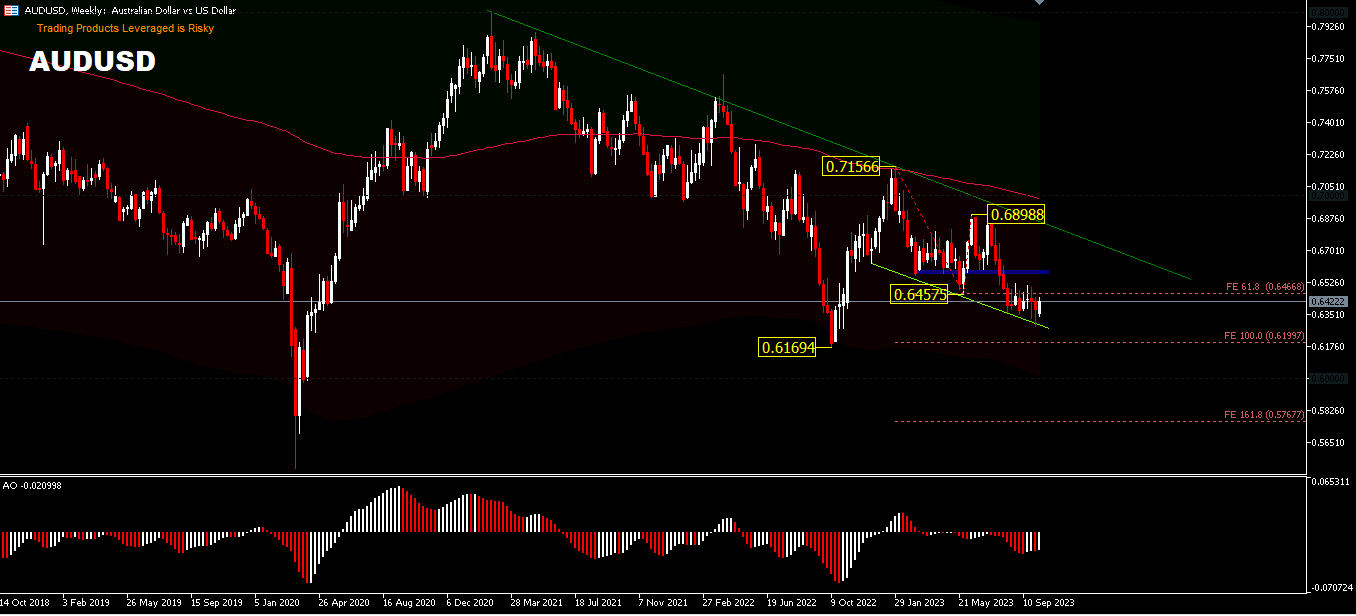

AUDUSD, W1

The USDIndex fell -0.23% on Tuesday and recorded a 1-week low. Yesterday, a rally in stocks and comments from Atlanta Fed President Bostic reinforcing speculation that the Fed is heading towards a pause in rate hikes, curbed demand for dollar liquidity. Nonetheless, the Dollar’s decline was limited as the ongoing turmoil in the Middle East increased safe-haven demand for the Dollar. Atlanta Fed President Bostic said, that he felt there was no need to raise rates again and that he thought the current policy rate was at a sufficiently restrictive position to bring inflation down to 2%.

Meanwhile, the Australian Dollar has experienced more weakness and volatility than any other currency recently due to shifting demand in China.

Australian Dollar futures recorded record interest from traders in September. Australia exports a large amount of commodities such as gold, iron ore and coal, so it makes sense that their currency has a positive correlation with the demand and price of these goods.

AUDUSD weakness is also a reflection of US interest rate developments, which reinforces the idea that the Federal Reserve could keep interest rates higher for longer. As the statistics change, so does the Fed’s rhetoric, changing their dot plot forecast of the Fed Funds rate in 2024 to 5.1% from 4.6% at their meeting on 20 September. The obvious conclusion is that the market is in favour of the Fed and more importantly the idea of a soft landing which allows interest rates to remain high.

Meanwhile, the RBA in its October meeting decided to keep interest rates at the current level of 4.1%. The Australian dollar futures market price is still very close to the lowest point before the pandemic hit in early 2020. This suggests that market participants think this may be a pause before the price increase cycle resumes in the coming months.

RBA Assistant Governor Chris Kent indicated that while the impact of previous monetary tightening has not fully materialised, some further tightening may be in order to keep inflation in check. He emphasised that the current policies are starting to constrain demand growth, which is an important step towards mitigating inflation. However, with inflation remaining high, he signalled the need for additional measures.

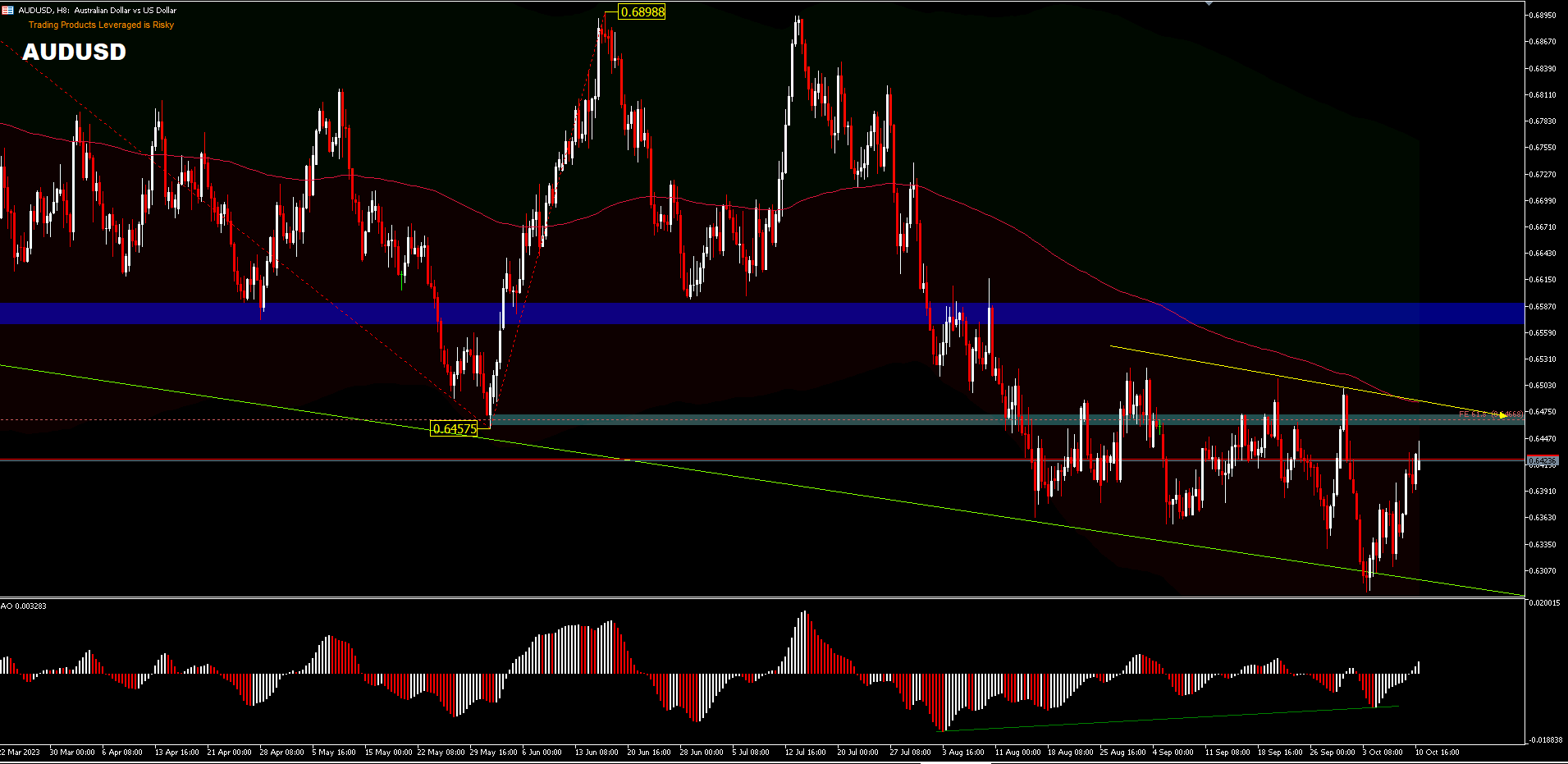

AUDUSD, H8

From a technical point of view, the outlook for AUDUSD hasn’t changed much as the bears’ dominance could still persist, despite thin trading in the last 8 days. Intraday bias remains neutral at this point, As long as price trades below 0.6457 support price bias may return to the downside for FE100% projection at 0.6199 near last year low of 0.7156 – 0.6457 and 0.6898 pullback.

Click here to access our Economic Calendar

Ady Phangestu

Market Analyst – HF Educational Office – Indonesia

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.